Optimize Your Home Financing Possible with a Mortgage Broker Glendale CA

Optimize Your Home Financing Possible with a Mortgage Broker Glendale CA

Blog Article

Exactly How a Mortgage Broker Can Assist You Browse the Complexities of Home Funding and Financing Application Processes

A home mortgage broker offers as an educated intermediary, geared up to simplify the application process and tailor their technique to specific economic situations. Understanding the full range of exactly how a broker can assist in this trip elevates vital questions regarding the nuances of the procedure and the possible mistakes to avoid.

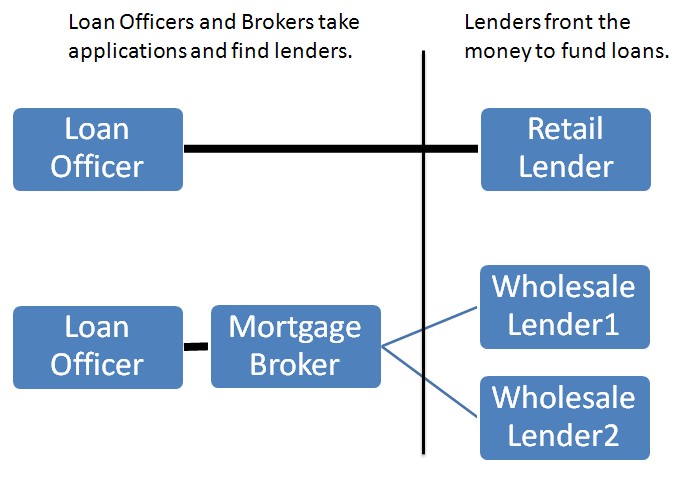

Comprehending Home Loan Brokers

Home loan brokers have solid relationships with several lenders, giving customers access to a wider series of mortgage items than they could locate on their own. This network enables brokers to discuss far better terms and prices, eventually profiting the customer. Additionally, brokers aid customers in gathering necessary documents, completing application forms, and making certain conformity with the loaning requirements.

Advantages of Making Use Of a Broker

Utilizing a mortgage broker provides countless advantages that can considerably enhance the home financing experience - Mortgage Broker Glendale CA. One of the primary advantages is access to a wider variety of loan items from several lenders. Brokers possess substantial networks that enable them to present alternatives tailored to individual monetary situations, possibly bring about much more competitive prices and terms

In addition, home loan brokers provide important proficiency throughout the application process. Their knowledge of local market conditions and lending methods allows them to direct customers in making notified choices. This competence can be specifically beneficial in browsing the paperwork demands, making certain that all needed paperwork is completed accurately and submitted on time.

Another advantage is the potential for time savings. Brokers deal with much of the research, such as collecting info and communicating with lending institutions, which allows clients to focus on other facets of their home-buying trip. Brokers commonly have actually established relationships with loan providers, which can help with smoother negotiations and quicker authorizations.

Browsing Loan Options

Navigating the myriad of finance options available can be frustrating for several buyers. With various kinds of home mortgages, such as fixed-rate, adjustable-rate, FHA, and VA car loans, identifying the most effective suitable for one's monetary scenario needs cautious consideration. Each loan type has distinctive characteristics, benefits, and potential disadvantages that can dramatically impact lasting affordability and monetary security.

A home mortgage broker plays an essential duty in streamlining this procedure by supplying tailored guidance based on specific situations. They have access to a vast selection of loan providers and can aid property buyers compare different finance products, guaranteeing they recognize the terms, rates of interest, and repayment structures. This expert understanding can reveal alternatives that might not be readily noticeable to the typical consumer, such as particular niche programs for novice customers or those with unique financial circumstances.

In addition, brokers can help in determining the most ideal lending amount and term, lining up with the purchaser's budget plan and future goals. By leveraging their know-how, property buyers can make informed choices, stay clear of common mistakes, and ultimately, secure financing that aligns with their requirements, making the journey towards homeownership much less complicated.

The Application Refine

Comprehending the application procedure is important for possible property buyers intending to protect a home loan. The mortgage application procedure generally starts with event required paperwork, such as proof of income, income tax return, and details on properties and financial debts. A mortgage broker plays a pivotal function in this stage, helping clients put together and arrange their economic records to offer a full image to loan providers.

When the paperwork is prepared, the broker sends the application to multiple loan providers in behalf of the debtor. This not only enhances the process yet likewise enables the customer to contrast numerous loan alternatives successfully (Mortgage Broker Glendale CA). The lender will after that conduct an extensive review of the application, that includes a credit history check and an evaluation of the debtor's financial security

This is where a home mortgage broker can offer vital assistance, making certain that all requests are addressed promptly and precisely. By navigating this complicated procedure, a mortgage broker assists consumers prevent potential risks and accomplish their home funding objectives effectively.

Long-lasting Economic Advice

Among the essential benefits of dealing with a mortgage broker is the arrangement of long-lasting economic assistance customized to specific conditions. Unlike typical lenders, home loan brokers take an all natural technique to their customers' financial wellness, considering not only the prompt funding requirements yet additionally future monetary goals. This tactical preparation is crucial for homeowners that intend to keep monetary security and construct equity gradually.

Home loan brokers evaluate different elements such as earnings stability, debt background, and market find more information fads to recommend one of the most appropriate financing items. They can additionally provide guidance on refinancing choices, prospective investment chances, and strategies for debt monitoring. By establishing a long-lasting partnership, brokers can help customers browse changes her response in rates of interest and property markets, making certain that they make informed choices that line up with their evolving monetary needs.

Conclusion

In verdict, engaging a home mortgage broker can considerably minimize the complexities linked with home financing and the lending application process - Mortgage Broker Glendale CA. Eventually, the assistance of a mortgage broker not just streamlines the immediate procedure however also gives important long-term financial assistance for borrowers.

Mortgage brokers possess strong partnerships with several lending institutions, offering customers access to a broader range of home mortgage products than they might find on their own.Moreover, home mortgage brokers provide indispensable support throughout the loan application process, helping customers comprehend the nuances of their funding choices. On the whole, a home loan broker serves as a anonymous knowledgeable ally, streamlining the mortgage experience and improving the chance of safeguarding favorable car loan terms for their clients.

Unlike standard loan providers, home loan brokers take an alternative technique to their clients' economic health, thinking about not just the immediate loan needs however additionally future economic objectives.In final thought, engaging a mortgage broker can significantly reduce the intricacies connected with home financing and the loan application process.

Report this page